Friends,

We don’t have to rely on the federal government — which remains shuttered, whose Republican-controlled Congress remains dysfunctional, whose Supreme Court emits elusive mutterings from its shadow docket, and whose president is nuts — to advance a progressive agenda. Several states are taking up the baton.

Case in point: I recently joined with one of California’s most powerful unions (SEIU’s United Healthcare Workers West, whose members work in hospitals and clinics across the state) and one of the nation’s most respected economists (Berkeley’s Emmanuel Saez) to unveil a 2026 California state ballot measure that would establish the nation’s first wealth tax.

It’s an emergency tax on billionaires, to make up for the $100 million hit to California’s Medicaid program that Trump and his Republican Congress made in their One Big Beautiful (big ugly) bill. That bill, you’ll recall, cut taxes mainly for the wealthy and paid for it by reducing federal appropriations for Medicaid.

If the measure qualifies for the November 2026 ballot and were to be enacted by California voters, it would levy a 5 percent tax on the wealth of the state’s roughly 200 billionaires. It would direct 90 percent of those funds to California’s Medicaid recipients and the institutions that serve them (with the remaining 10 percent going to the state’s K-12 schools).

Its purpose is to address what would otherwise be a crisis for many Medicaid recipients and the hospitals and clinics that treat them.

Yet the measure could have much broader implications for America, at a time when the fortunes of the ultra wealthy have reached the stratosphere while median incomes are stagnant and public funding is shrinking.

Indeed, proposals to raise taxes on the ultra wealthy to finance what average working people need are emerging in several places — most notably in New York City, where Democratic mayoral nominee Zohran Mamdani (who may be elected the city’s next mayor tomorrow) aims to raise the income taxes of residents with annual incomes in excess of $1 million by 2 percent in order to fund universal child care.

Such proposals have raised predictable outrage from the rich, along with threats that they’ll move elsewhere where taxes are lower and dire predictions that their fellow plutocrats will refuse to move in.

Yet there’s scant evidence for these consequences. In fact, when Massachusetts passed a “millionaires tax” in 2023, conservatives claimed the rich would flee. But two years later, they haven’t — and Massachusetts has collected $5.7 billion for infrastructure and public education.

Note also that the California proposal is a one-time-only tax and would be levied exclusively on billionaires’ current net worth in 2025.

So even if they decide to move to the Virgin Islands, they’ll still be liable for 5 percent of their wealth in 2025. (They can stretch out their payments over the next five years, but their payments will still be based just on their net worth in 2025.)

By the same token, the tax won’t crimp the fortunes of any billionaire who moves into California next year or any later year, as it applies only to the billionaires living in the state this year.

The incomes of America’s billionaires have been rising by an average of 7.5 percent a year since the start of the pandemic — in sharp contrast with the measly 1.5 percent average increase for median-income Americans. So even after the 5 percent tax is levied, the ultra wealthy will still be getting wealthier at a rapid clip.

The sums they’ll owe are readily calculable, since about 72 percent of billionaires’ wealth is in their ownership of publicly traded stock. As they do with their payment of income taxes, billionaires would file their wealth taxes themselves in 2027 (assuming the measure had been enacted the previous November) based on their net worth in 2025. The state can audit those returns if its estimates of their fortunes are significantly at variance with those filings.

The politics of this couldn’t be better — given that 15 million Californians on Medi-Cal (the state’s version of Medicaid) are on the brink of losing much if not all of their health insurance because of cutbacks imposed by Trump and congressional Republicans — who, again, redirected those funds to massive tax cuts for the rich.

And remember, this tax affects just 200 billionaires.

(Californians have until June to collect the required number of valid signatures — roughly 874,000 — to place it on the November 2026 ballot.)

This isn’t the final answer to America’s disgraceful inequalities of wealth and income, of course, but it’s a start. It may open the way to further efforts to rein in the obscenely rich. Hopefully, Mamdani’s election tomorrow will open up another.

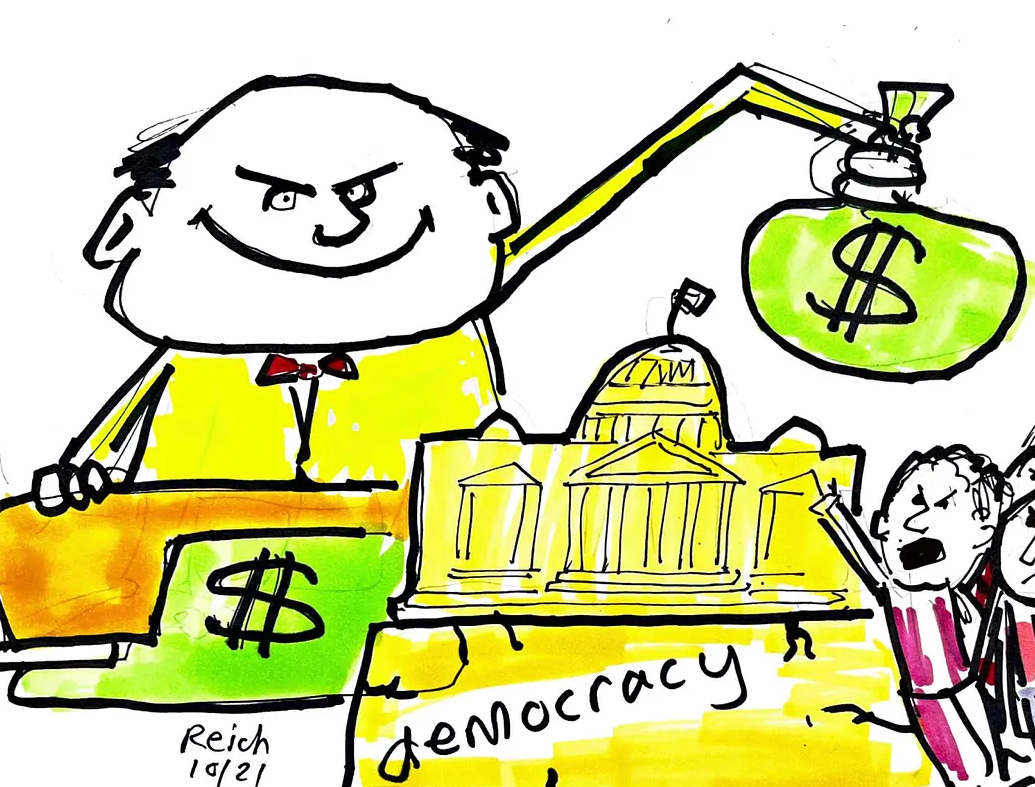

These efforts are essential not only to funding what most people need but also to preserving our democracy.

They also offer powerful reminders that even with Trump lording over America like a giant slug, positive change can and will still happen at the state (and city) level.

I’ll continue to highlight the most promising and important state proposals.

This post has been syndicated from Robert Reich, where it was published under this address.