Yesterday, I published an article that began:

“Welcome to the Great AI Bubble, a metastasized trillion dollar tech tumour so massive it’s practically visible from space.”

And today, in a strange bit of timing, news lands that Peter Thiel – the closest thing the modern world has to a real-life Bond villain – has dumped his entire holding in Nvidia, the chip manufacturer. That’s the company which, alongside OpenAI, sits at the very centre of a trillion dollar…gamble. Or, as some people are calling it, a bubble. A bubble that could upend the entire US economy.

And Thiel’s move is the strongest signal yet that Silicon Valley not only knows that this is a bubble, it’s starting to feel spooked. Or, is this some bizarre 3-D chessgame that only Peter Thiel understands?

If you haven’t read that first article, I’d recommend starting there:

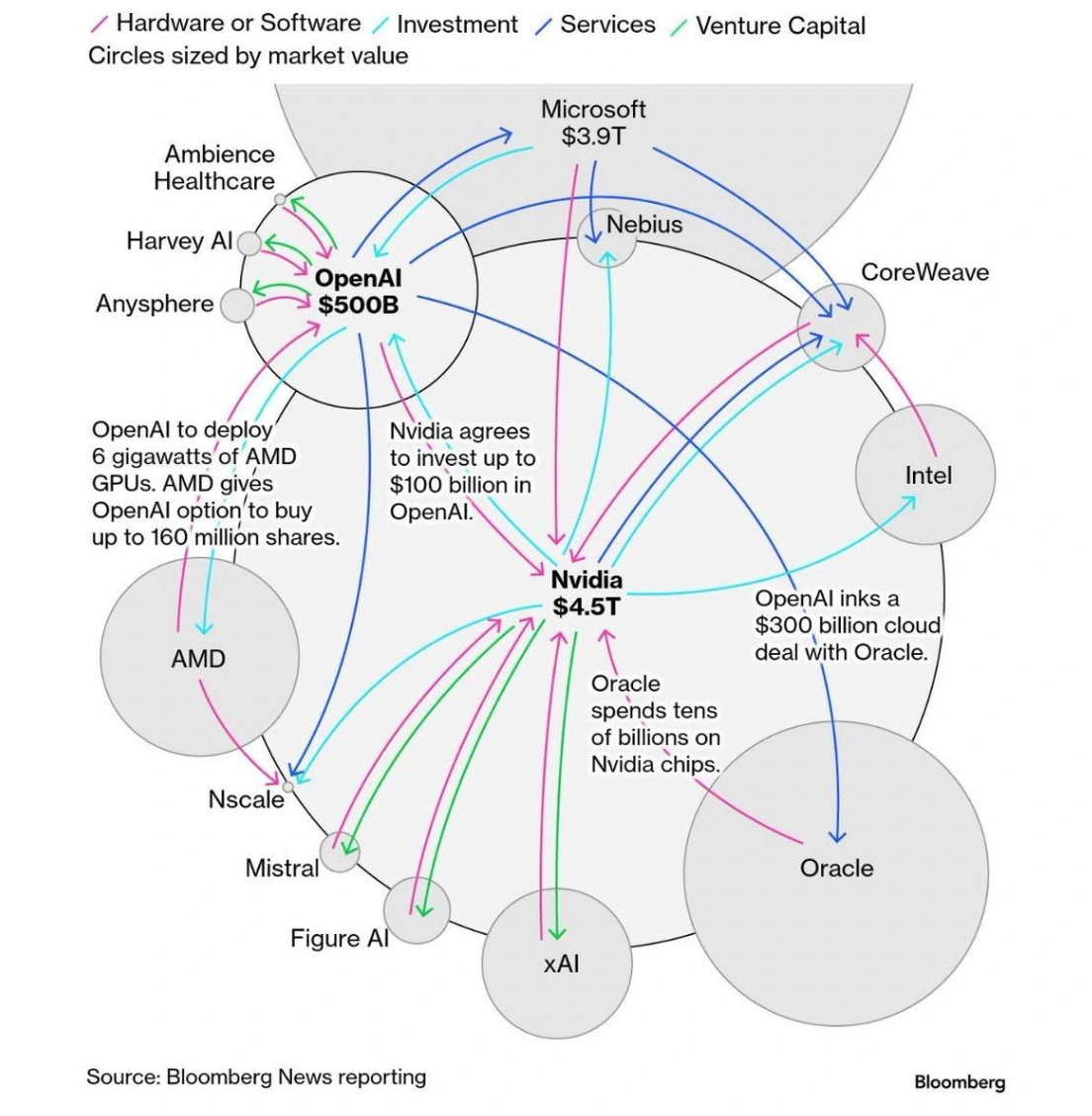

To understand the significance of today’s news and why I’ve decided to post again is because a) it’s Peter Thiel, the dark lord of Silicon Valley. And b) It’s Nvidia, the company that, as this chart shows, is at the centre of everything:

I bigged up that chart yesterday for the way it translates a whole lot of complicated financial deals into an image even us normies can understand: a circular economy supported by breathless articles about the uber-bros who believe they are capturing the future.

But here’s another image to burn into your eyeballs. This is the change in Peter Thiel’s share holdings that was revealed today. Second from the bottom you’ll see ‘NVDA’. That’s Nvidia, and the words next to it: “SOLD ALL”.

Or as Investing.com put it, he’s dumped the stock owing to “bubble fears”. It calculates the sale at roughly $100m. And Thiel didn’t stop there, he also slashed his holding in Elon Musk’s Tesla and liquidated his shares in energy company Vistra.

Thiel, a keen chess player, who prides himself on his ability to think twelve steps ahead seems to believe there’s a bloodbath coming. If it is a bloodbath – and that’s what the experts I quoted in my piece yesterday are also saying – then it is a bloodbath that Peter Thiel, an early investor in OpenAI, helped create. And which, he now, will in some way or another be looking both to profit from and control.

This October, Nvidia became the world’s first $5 trillion company. But it was also the world’s first $4 trillion company, a landmark it reached just a few months earlier in July this year. And that’s just two years after it hit what was then considered a huge milestone: $1 trillion.

This isn’t so much “growth” as cancer. There’s nothing healthy about a share price that looks like a late-stage diagnosis. Nvidia is at the centre of a game of musical chairs that is holding up most of the US stock market. And the experts that I quote in my piece say is that at some point the music has to stop.

The fact that it’s Nvidia and Thiel is what makes this such a toxic combo. Peter Thiel is the ur-broligarch. He cultivates a quasi Bond villain persona with an actual James Bond villain’s lair in New Zealand that he bought in case things get bumpy, which if the global economy was to collapse, would be one description for it. Thiel’s surveillance company Palantir, a military contractor to the US and Israeli governments among many others, is not just an intrusive and creepy data harvester, it’s a human rights black hole.

On an earnings call earlier this year, Palantir’s CEO, Alex Karp, a man who struggles to keep his more Messianic tendencies in check, boasted about killing people “when necessary”. That this company operates both inside Gaza surveilling and profiling people for execution and inside the UK NHS handling our most sensitive private data is one of the more sociopathic data points of the modern age.

Thiel’s ultimate goal is shadowy. But destroying and then re-making society from the ruins is certainly up there. He recently gave a series of lectures centred on his belief that the Antichrist is coming and there will be an apocalyptic endgame between good and evil. That’s not some sort of tortured metaphor, by the way. He means the actual Antichrist, who he thinks may or may not be Greta Thunberg.

In a recent New York Times interview with Ross Douthat, there was an amazing moment where he couldn’t definitively say that he wanted humanity to survive:

Douthat: “You would prefer the human race to endure, right?”

Thiel: “Uh…”

Douthat: “You’re hesitating.”

Thiel: “Yes. I don’t know. I would..

Douthat: “This is a long hesitation.”

Thiel: “There’s so many questions implicit in that.”

Douthat: “You would prefer the human race to survive?

Thiel: “Yes. But I would also like us to radically solve these problems.”

The “problems” Thiel wants to solve is human biology. He wants to solve death. Not everyone’s, obviously. Why would he want us hanging around for eternity? It’s his own potential demise that bothers him. He was an early adopter of the vampiric Silicon Valley practice of transfusing the blood of virgins young men into his veins. And as he continues in the NYT interview: he’s seeking a “radical transformation where your human, natural body gets transformed into an immortal body”.

These are dangerous people. Breaking society in order to re-make it is a Thielian dream. And a global financial crash would certainly be one way to accelerate that concept. Could he actually be trying to start a run on the market?

It’s not a coincidence that the first person I’ve seen post on this outside a small circle of tech sceptics and tech investors and a few business reporters is the writer, Naomi Klein.

Klein wrote an entire book called “The Shock Doctrine” which detailed how all capitalism is “disaster capitalism”, an economic system that exploits global shocks and human misery to accrue ever greater wealth and power for the few. And this is what she posted this morning:

If Peter Thiel is aware of Klein’s Shock Doctrine, he probably views it as a handbook.

And what Klein is referring to here is that we know what happens when reckless out-of-control investors fuck things out: they get bailed out. They don’t get held to account. They don’t lose their shirts. It’s the little people – us – who pay the price for years. In Britain, an estimated 335,000 additional deaths can be attributed to the policy of ‘austerity’ that followed the financial crisis. (And the man who oversaw it is now gunning for the top job at HSBC bank. Because of course he is.)

And Klein is specifically referencing here, a suggestion floated last week by OpenAI that it might need some sort of “guarantee” from the US government, aka a bailout.

Yesterday, I quoted Roger McNamee in my newsletter as the first person who’d suggested to me what we were seeing was a bubble some 18 months ago. He’s a Silicon Valley VC who was one of the earliest investors in Facebook and was a mentor to Mark Zuckerberg and I want to quote a bit more of what he told me here:

“The CFO of OpenAI, Sarah Friar, gave the game away a week ago when she said that she was thinking that there was a role for the government to play in backstopping the future investments of companies like OpenAI, that is a terrible idea.[…]

You know, everybody on Wall Street is excited about this bubble. 34% of the market value is in the big companies. The private ones have notional values that would make them, you know, Fortune 200 companies.

It’s the whole thing is crazy, but it can keep going on because, you know, there’s just no way to tell when a bubble is going to end. When it does, though, it’s going to end with, I think, a bang. And I believe that the government will probably try to bail these guys out, which would be a terrible idea, but politically, I think that’s where things are right now.”

The Big Hypocrisy

One spicy fact I left out of my piece yesterday was that Michael Burry, the legendary investor at the centre of Michael Lewis’s book on the financial crisis, The Big Short, shocked the market last week. He also decided AI’s a bubble and he took action: shortselling not just Nvidia but also Palantir.

Burry was the genius savant played by Christian Bale in the movie of the same name. He spotted the signs of impending meltdown in the sub-prime housing market that everyone else had missed. And since then, he’s had dedicated fans who follow his every move.

I didn’t include this yesterday because I didn’t want to get too far into the weeds. But Burry is interesting. Because of his profile. Because his actions it did spook the market. And because it led to a furious riposte from none other than…Alex Karp, CEO of Palantir, and long-time business partner of Peter Thiel.

Karp went on cable news to furiously denounce Burry who he more or less accused of unAmerican behaviour:

”When I hear short sellers attacking what I believe is clearly the most important software company in America — and therefore the world, in terms of our impact — simply to make money, and trying to call the AI revolution into question . . . [it] is super triggering to me,” he said.

So what gives, Peter Thiel? What’s the game? Is it 3-D chess? Or has he simply ripped the cord on his parachute and decide to bail? Thiel’s own CEO castigates anyone who “calls the AI revolution into question” But then he does a runner from the biggest company in the market. Do feel free to chip in below, in the comments if you have thoughts on this?

And now Michael Burry has take even more dramatic action. He has closed his entire investment fund saying, “My estimation of value in securities is not now, and has not been for some time, in sync with the markets.” Business Insider reports he also left a “cryptic message” on Twitter:

Yep. That’s how it goes. Cassandra Cadwalladr signing out here for the day. More soon.

This post has been syndicated from How to Survive the Broligarchy, where it was published under this address.